World-class support combined with award-winning healthcare solutions.*

Improve your financial performance and patient engagement with best-in-class healthcare technology backed by personalized support.1

Achieve the stability to thrive independently

Quatris Healthco and athenahealth have combined our personalized support and comprehensive technology to help you get the most from your healthcare IT.2 Together, we’re able to simplify your experience of the healthcare system and help you get paid more, faster, with less work.

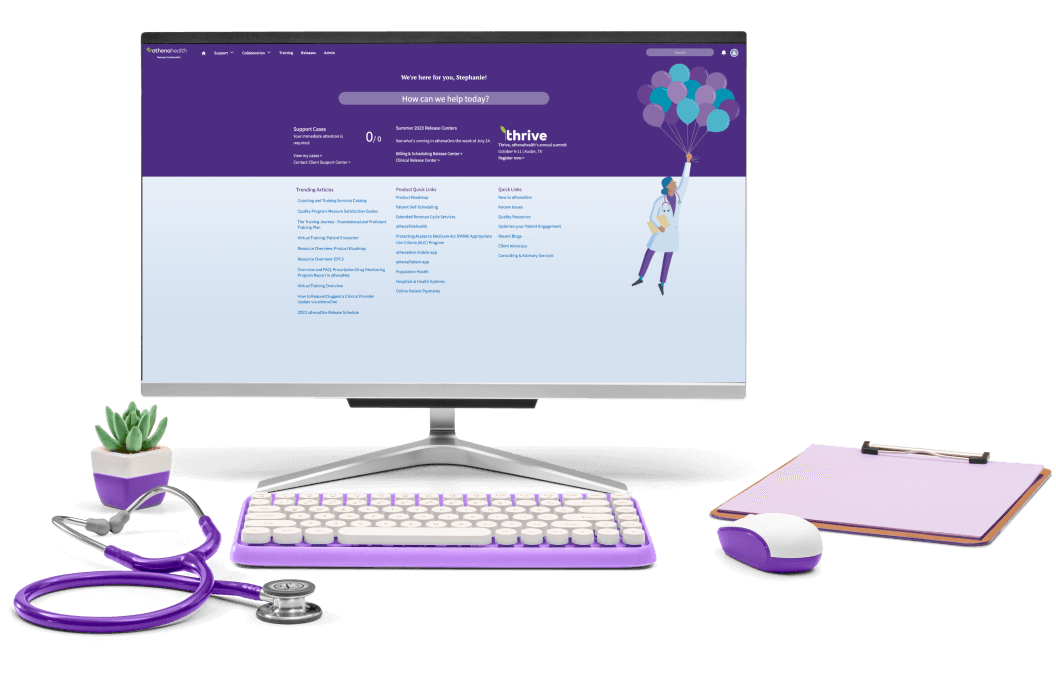

Resources for existing customers

Quatris Healthco customers can find all your customer information and resources on the athenahealth Success Community.

Flexible solutions for any size organization

Whether you’re a one-provider practice, an independent physician group, or a large multi-specialty, we can help improve your organization’s efficiency and speed up your revenue cycle.

* Quatris Healthco’s customer NPS score is in the top 1% for the industry as of July 2023.

1. athenahealth’s EMR and RCM solutions were awarded multiple “Best in KLAS” awards for 2023.

2. Quatris Healthco is now a wholly-owned subsidiary of athenahealth.